Withdrawing Money from PayPal to M-Pesa can be a Tussle for a Business.

Here’s all the info on PayPal Transfer in these Quick Steps in Kenya.

PayPal, quite a popular online payment platform, facilitates the international transfer of funds between individuals and businesses.

For many in Kenya, particularly freelancers, online entrepreneurs, and businesses, PayPal is really important for handling payments across borders.

Now, a really key point is that being able to efficiently get those funds out of PayPal and into a mobile money service, such as M-Pesa, makes getting access to your money much quicker and way more convenient.

In this guide, we will walk you through the step-by-step process of withdrawing money from PayPal to M-Pesa in Kenya.

How to Withdraw Money from PayPal to M-Pesa in Kenya

Step 1: Ensure You Have a PayPal and M-Pesa Account

Before initiating a withdrawal, you need to have active accounts on both PayPal and M-Pesa.

If you don’t have an account yet, follow these steps:

Creating a PayPal Account

- Visit the PayPal website.

- Click on Sign Up and select either a personal or business account.

- Provide your details, including email address, name, and password.

- Verify your email address and link your account to your bank or debit card for transactions.

- Log in using your PayPal login credentials to complete the process.

Creating an M-Pesa Account

- Ensure you have a registered Safaricom SIM card.

- Dial *334# to activate your M-Pesa account.

- Follow the prompts to set your PIN and access M-Pesa services.

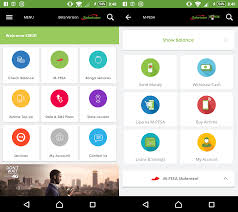

Step 2: Link Your PayPal Account to M-Pesa

To successfully withdraw funds, you need to link your PayPal account to M-Pesa.

This process is facilitated through the official PayPal M-Pesa service powered by Thunes.

How to Link PayPal to M-Pesa

- Go to the PayPal M-Pesa website.

- Click on Get Started and log in with your PayPal details.

- Enter your Safaricom M-Pesa number and verify it with the code sent via SMS.

- Accept the terms and conditions and complete the linking process.

Step 3: Verify Your PayPal Account

To ensure seamless transactions, verify your PayPal account by linking it to a debit or credit card.

This prevents withdrawal limits and enhances security.

To check your PayPal limit:

- Log into your PayPal account.

- Navigate to the Account Limits section to view any restrictions.

Step 4: Transfer Funds from PayPal to M-Pesa

Once your accounts are linked, you can initiate a withdrawal.

How to Withdraw Money from PayPal to M-Pesa

- Visit the PayPal M-Pesa portal and log in.

- Click on Withdraw from PayPal.

- Enter the amount you wish to withdraw (in USD).

- The system will display the exchange rate and the equivalent amount in Kenyan Shillings.

- Confirm the details and submit the request.

- You will receive an SMS from M-Pesa confirming the transaction.

Step 5: Check PayPal Fees and Exchange Rates

When withdrawing money from PayPal to M-Pesa, PayPal applies conversion fees based on the exchange rate.

To estimate these costs:

- Use the PayPal fee calculator online to determine the charges.

- PayPal also applies currency conversion fees when converting USD to KES.

Step 6: Access Your Funds on M-Pesa

The withdrawal process typically takes between 2 hours to 3 business days, depending on PayPal processing times.

Once completed, you will receive your funds in your M-Pesa account.

Common Issues and How to Fix Them

1. PayPal Withdrawal Delays

- Ensure your PayPal account is verified.

- Check for PayPal limits that may affect transactions.

- Contact PayPal support if funds are delayed beyond 72 hours.

2. Failed M-Pesa Withdrawal

- Ensure you have linked the correct Safaricom number.

- Confirm that your M-Pesa account is active.

- Retry the transaction or contact Safaricom support for assistance.

3. PayPal Login Issues

- Reset your password via the PayPal login page.

- If accessing PayPal from the UK, use the PayPal login UK option.

- Ensure you are using the correct email and password.

Alternative Methods to Withdraw Money from PayPal in Kenya

Apart from M-Pesa, you can also withdraw PayPal funds using:

- Equity Bank PayPal Withdrawal – Available for Equity Bank customers.

- Skrill – Log into your Skrill login account and transfer funds to a local bank.

- Western Union – Some third-party services offer PayPal to Western Union transfers.

- Cryptocurrency Exchanges – Convert PayPal funds into cryptocurrency and withdraw via mobile money.

Frequently Asked Questions (FAQs)

1. How Long Does It Take to Withdraw from PayPal to M-Pesa?

It usually takes 2 hours to 3 days, depending on PayPal processing times.

2. What is the Minimum Amount I Can Withdraw?

The minimum withdrawal amount is $1 USD.

3. How Do I Check My PayPal Balance?

Log into your PayPal account and check the balance under the Wallet section.

4. Are There Limits on PayPal to M-Pesa Withdrawals?

Yes, PayPal may impose limits based on account verification status. You can check your limits in your PayPal account.

5. Can I Receive PayPal Payments in Kenya?

Yes, Kenyans can receive PayPal payments from international clients, businesses, and marketplaces.

6. Can I Withdraw from PayPal Without Linking M-Pesa?

Yes, you can use Equity Bank, Skrill, or Western Union as alternative withdrawal options.

Conclusion

Getting cash from your PayPal to your M-Pesa? It’s pretty straightforward, really, and it means Kenyans can get their hands on their money fast.

If you just follow this guide, you’ll be able to connect things up, move your funds around, and stay on top of it all without much fuss.

Now, don’t forget to double-check that your PayPal account is all verified and such. Also, have a quick look at any charges involved.

Thus, figure out the best way to actually move the money, there are a couple of options, after all. Should you run into any snags and it can happen to anyone.

Hence, try those troubleshooting ideas, or just get in touch with the folks at PayPal or Safaricom. They’re usually pretty helpful.

When you get it all optimized, sending money back and forth between PayPal and M-Pesa becomes quite smooth.

It makes paying online and getting your cash out nice and easy in Kenya.

Read Also: How to Sell Pi-Coin