Are you looking to Buying shares in well-known Kenyan Brands like Safaricom and Equity? You are in the Right Spot!

Buying shares in well-known Kenyan companies like Safaricom, Equity Bank, Kenya Power, and Kenya Reinsurance Corporation has become one of the most accessible ways for individuals to invest and build wealth.

Thanks to technology and digital platforms, the process is now simpler and more transparent than ever.

This article explains, in factual and practical terms, how to buy equity shares, where to start, and what you should know before investing.

Understanding Equity Shares

Equity shares represent a portion of ownership in a company. When you buy equity shares in a company like Safaricom or Equity Bank, you become a shareholder, meaning you own part of the business. You gain the right to vote at annual meetings, receive dividends when profits are distributed, and benefit when the company’s share price rises.

In Kenya, most listed companies trade their equity shares through the Nairobi Securities Exchange (NSE), the country’s main stock market. This means that to invest in brands such as Safaricom, Kengen, Kenya Power, or Kenya Re, you must go through the NSE via an authorized stockbroker.

How to Buy Equity Shares in Kenya

To start investing in shares, you need a Central Depository System (CDS) account. This account holds your shares in electronic form, similar to how a bank account holds your money.

Step 1: Open a CDS Account

You can open a CDS account through any licensed stockbroker or investment bank in Kenya. Some of the reputable brokers include Dyer & Blair Investment Bank, NCBA Investment Bank, and Standard Investment Bank. You will be required to provide:

- A copy of your National ID or passport

- Passport-size photos

- Your KRA PIN

Once approved, you will receive a CDS number that enables you to trade shares through the NSE online or via your broker’s portal.

Step 2: Choose the Shares to Buy

Before deciding where to buy shares, it’s essential to research the brands you’re interested in. For instance:

- Safaricom PLC remains one of the most traded stocks in Kenya, known for its consistent dividend payouts. As of October 2025, the Safaricom share price today hovers around KSh 17.20, although it can fluctuate based on market conditions.

- Equity Group Holdings is one of Africa’s leading financial institutions. Learning how to buy shares in Equity Bank is straightforward once you have your CDS account. Hence, just search for its trading code “EQTY” on the NSE platform.

- Kenya Power (KPLC) is another popular stock among investors. Many are interested in how to buy Kenya Power shares, especially since its performance directly reflects Kenya’s economic growth.

- Kenya Reinsurance Corporation (Kenya Re) offers long-term investment potential, given its steady dividend policy and presence across African markets.

Step 3: Place an Order Through Your Broker

After selecting a company, you can instruct your broker to buy a specific number of shares at the prevailing market rate.

For example, if you want to invest in Safaricom shares via CDS, your broker will execute the trade on your behalf.

Step 4: Monitor Your Investment

Once you’ve bought shares, regularly monitor market updates through the NSE website or your broker’s trading app. Check prices such as the Kengen share price today, Safaricom share price, and other leading NSE shares to buy today to stay informed about market movements.

Where Can I Buy Shares in Kenya?

You can buy shares through:

- Licensed Stockbrokers – These are professionals registered with the Capital Markets Authority (CMA) who handle trades on the NSE.

- Online Trading Platforms – Some banks and investment firms have user-friendly apps that allow you to buy and sell shares directly.

- Investment Banks – For larger or more diversified portfolios, investment banks can guide you on which shares to buy today in Kenya based on market trends.

Why Invest in Kenyan Brands?

Investing in Kenyan companies is not only about profit; it’s also about supporting local growth. When you buy shares in companies like KPLC or Kenya Re, you are helping fund their operations and expansion.

Moreover, long-term investors often benefit from dividends and capital appreciation, especially when investing in solid brands with strong governance.

Kenya’s stock market has shown resilience despite global challenges. For example, according to NSE reports, market capitalization in 2025 rose compared to previous years, driven by renewed investor confidence and technological innovation in the trading system.

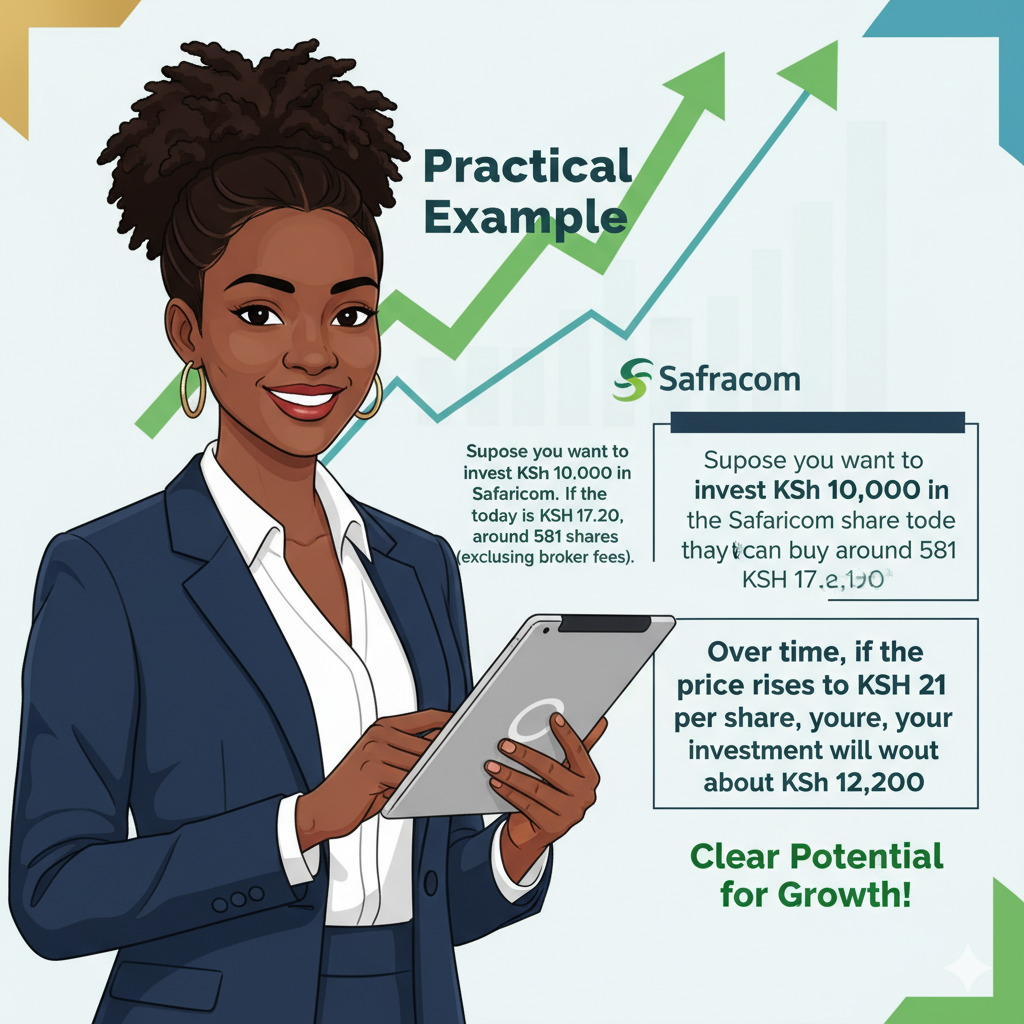

Practical Example

Suppose you want to invest KSh 10,000 in Safaricom. If the Safaricom share price today is KSh 17.20, you can buy around 581 shares (excluding broker fees).

Over time, if the price rises to KSh 21 per share, your investment will be worth about KSh 12,200 showing a clear potential for growth.

Final Thoughts

Learning how to buy shares on brands such as Safaricom, Equity Bank, Kenya Power, or Kenya Re is an empowering step toward financial independence. The process, once perceived as complex, has been simplified through digital platforms and regulated brokers.

Are you a first-time investor or an experienced trader looking for NSE shares to buy today? remember to do thorough research, diversify your portfolio, and monitor the market regularly. Kenya’s stock market remains one of the most promising in Africa.

Thus, with the right approach, your investment in these trusted brands could yield rewarding returns in the long run.