Want to Learn How to File KRA Returns in Kenya?

Quick fix, Here is a Step-by-Step Guide for Brands, Employees and Individuals in 2025.

Okay, so you’re thinking about filing taxes with the KRA, right? Well, in Kenya, every taxpayer has to file, period.

If you’re employed, Brand, self-employed, part of a larger organization, or, say, currently looking for work, the KRA wants to hear from you.

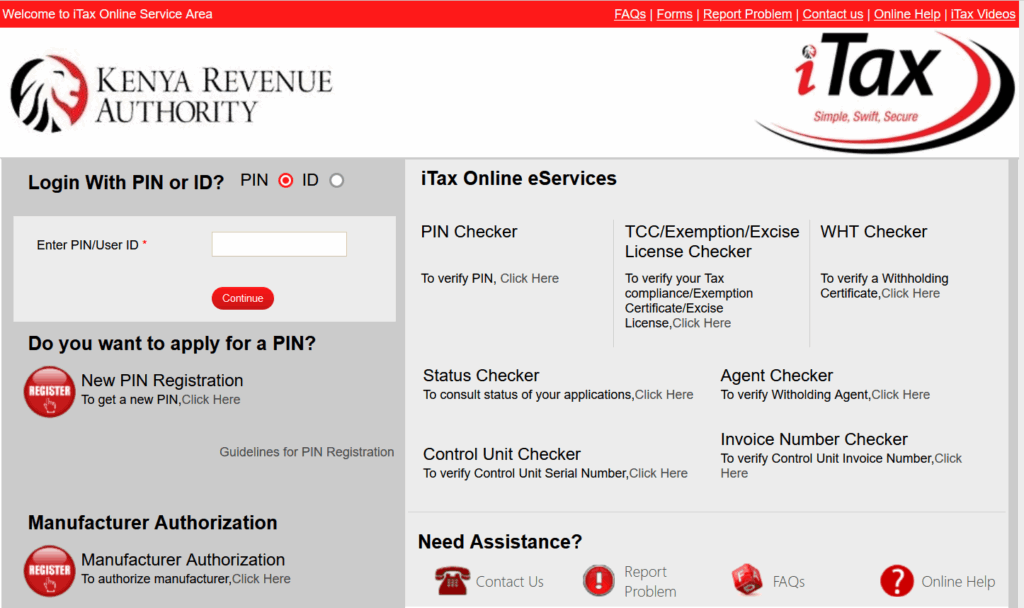

Good thing the Kenya Revenue Authority provides iTax. This portal is meant to simplify electronic filing; in some cases, you can even use your P9 form or smartphone.

Also, maybe you had no income to declare? You can file a nil return.

This detailed blog will guide you on how to file KRA returns for Brands, including steps on using your phone, filing with or without a P9 form, and handling nil returns.

What You Need Before Filing KRA Returns

Before you begin the filing process, ensure you have the following:

- A valid KRA PIN registered on the iTax portal

- Access to your iTax login credentials

- Your P9 form (if employed)

- A reliable internet connection (you can use your phone or computer)

- A working email address (to receive confirmation of submission)

How to File KRA Returns Using P9 Form (For Employees)

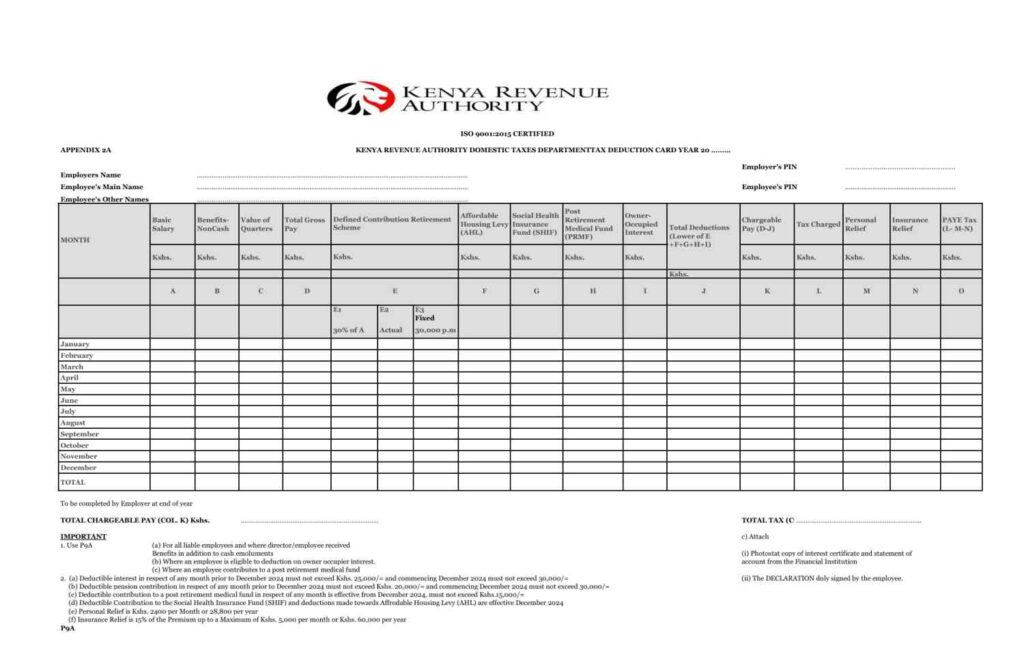

If you’re employed, your employer should provide you with a P9 form at the end of the financial year.

This document outlines your total earnings, benefits, and taxes deducted.

Steps on how to file KRA returns using P9 form:

- Visit the KRA iTax portal

- Enter your KRA PIN and click Continue

- Enter your password, solve the arithmetic CAPTCHA, then log in

- On the menu, select Returns > File Return

- Choose Income Tax – Resident Individual

- For the return period, select the year you’re filing for, e.g., 2024

- Download the Excel tax return form (or use the online form if available)

- Fill the form with data from your P9 form:

- Gross pay

- Allowances and benefits

- Pension contributions

- Tax deducted (PAYE)

- Validate the Excel form and upload it to the portal

- Submit and download your Acknowledgment Receipt

N/B Filing KRA returns for employees is straightforward once you have the P9 document. Always double-check your entries to avoid errors.

How to File KRA Returns Using Your Phone

Wondering how to file KRA returns using your phone? It’s possible to complete the entire process on a smartphone without needing a computer.

Steps on how to file KRA returns using your phone:

- Open a browser (Chrome works best)

- Go to the KRA portal

- Log in with your KRA PIN and password

- Follow the same steps as on a computer (Returns > File Return)

- Fill in the required information using the online form

- If uploading an Excel form, ensure your phone supports Microsoft Excel or Google Sheets

- Submit the return and download the acknowledgment receipt to your device

With a stable internet connection, you can file your tax returns conveniently from anywhere in Kenya.

How to File Nil Returns on KRA iTax Portal

Nil returns are for individuals who did not earn any income during the financial year.

This often applies to students, unemployed individuals, or KRA PIN holders not engaged in business.

Steps on how to file nil returns:

- Visit the iTax portal

- Log in with your KRA PIN and password

- Click on Returns > File Nil Return

- Choose Income Tax – Resident Individual

- Select the appropriate tax year, e.g., January to December 2024

- Confirm details and click Submit

- Download the Acknowledgment Receipt

Knowing how to file nil returns KRA ensures you avoid penalties for non-compliance.

Forgot Your KRA iTax Password? Here’s How to Reset

If you’ve forgotten your password, don’t panic. Resetting is easy:

- Go to itax.kra.go.ke

- Click on “Forgot Password”

- Enter your KRA PIN

- Click Submit

- You’ll receive a reset link in your registered email. Follow it to set a new password

If you no longer have access to the registered email, you may need to visit a KRA office or Huduma Centre.

How to File KRA Returns with Withholding Tax

If you’ve received income such as consultation fees or dividends subject to withholding tax, you are still required to file a return.

Here’s how to file KRA returns with withholding tax:

- Log into your iTax account

- Navigate to Returns > File Return

- Download the Income Tax Return Excel Form

- Fill in your income and withheld tax in the relevant sections

- Validate, upload, and submit

- Attach the withholding tax certificate (WHT) issued by the payer

How to File KRA Returns Without P9 Form

If you’re employed but your employer hasn’t issued a P9 form, you can still file returns by checking your payslips and calculating your totals.

- Collect all your monthly payslips

- Sum up your gross salary, benefits, and PAYE

- Use this information to manually fill in the Income Tax Return Form

- File as explained earlier in the “with P9” section

Alternatively, reach out to your employer or HR department to request the P9 document.

Final Tips on Filing KRA Returns in Kenya

- File your returns between January 1st and June 30th every year

- Filing late attracts a penalty

- Always keep a copy of your Acknowledgment Receipt

- Ensure your email and phone number on iTax are up to date

- If unsure, visit a Huduma Centre or a registered tax agent for assistance

Importance of Brands Filing KRA Returns in Kenya

Filing KRA (Kenya Revenue Authority) returns is not just a legal obligation, it comes with important personal and financial benefits.

Whether you are employed, running a business brand, or unemployed, submitting your returns through the iTax portal every year ensures that you stay compliant and enjoy several advantages.

Here are key reasons why filing KRA returns is important:

1. Compliance with the Law

In Kenya, it is a legal requirement for every individual or business with a KRA PIN to file annual tax returns, even if you had no income (nil returns).

Failure to file can lead to penalties, fines, or legal issues. Filing keeps you on the right side of the law.

2. Avoidance of Penalties

Missing the KRA return filing deadline (usually June 30th every year) attracts an automatic penalty. For individuals, the penalty can go up to KSh 2,000 or 5% of the tax due, whichever is higher.

Businesses face even stiffer fines. Filing on time saves you from unnecessary financial losses.

3. Helps in Accessing Financial Services

Banks and other financial institutions often require your latest KRA tax compliance certificates when applying for loans, mortgages, or tenders.

Regularly filing your KRA returns ensures you can easily obtain this important document when needed.

4. Required for Job Applications

Many employers, especially government bodies and large companies, ask for a tax compliance certificate during the job application process.

Thus, filing your returns each year keeps you eligible and ready to apply for new job opportunities.

5. Smooth Business Operations

For business owners and companies, updated tax compliance through regular filing is essential for:

- Bidding for government and private sector contracts

- Renewing business permits and licenses

- Building trust with partners, clients, and suppliers

6. Fulfilling Civic Duty

Paying taxes and filing returns contribute directly to Kenya’s development.

Taxes fund public services like health care, education, roads, and security. Filing your returns is part of fulfilling your civic responsibility.

7. Helps with Personal Record Keeping

When you file KRA returns, you get acknowledgment receipts and records of your financial year activities.

These documents are useful for personal financial management, verifying income, or tracking your tax obligations over time.

8. Eligibility for Tax Refunds

If you have overpaid taxes, the only way to claim a refund is by filing your returns. The KRA processes refunds based on accurate tax filings.

Hence, Filing ensures you can get back any extra money deducted from your income.

9. Enhances Financial Discipline

Preparing and submitting your tax returns encourages you to maintain good financial records throughout the year.

It helps you track your income, expenses, and investments better, leading to stronger financial management habits.

Why It Matters

To stay in good standing with Kenyan tax regulations, understanding the Kenya Revenue Authority’s (KRA) iTax system is quite vital.

Knowing how to appropriately submit tax returns, particularly when you’re using something like your P9 form as an employee, is key.

The iTax portal, in general, aims to streamline this submission process; this is true whether you’re submitting nil returns or accessing it from your mobile device.

The submission, itself, will cost you nothing, and filing tends to be quick, if you’ve followed the instructions laid out.

Read Also: